Author:Â Anastasiya Yarmoliuk, Communications Manager, Southern Ukrainian Office of the European Business AssociationÂ

Before the war, 75% of Ukraine's foreign trade was concentrated around seaports. From February 24, 2022, they are all blocked. However, this was not a verdict and we see that companies have begun to look for alternative ways to establish logistics chains.

Can rail and road transport replace shipping? How does the government help exporters? And what has changed for Ukrainian trade during the war? These issues were discussed on May 18, 2022, at an online meeting of logistics experts on the platform of the Southern Ukrainian Office of the European Business Association.

Container logistics: the challenges of wartime and the search for new opportunitiesÂ

Since February, we as a country have remained without access to the sea, and it is impossible to restructure our maritime logistics into the land ones. Therefore, the question arises as to how to direct our export and import flows to the land borders.

One of the immediate challenges, which the container business in Ukraine has faced in the first two weeks of the war, is finding alternative ways to deliver imported containers that were on their way to Ukraine. Unfortunately, as of the beginning of the war, thousands of imported containers were blocked. However, by mid-March, most industry players came together to work out the solutions. Thus, they came to several ways of delivering these goods from the ports of Constanta, Gdansk, and Gdynia. There were initially no shuttle trains connecting these ports with Ukraine, namely the western part. So, the focus was made on road transport, but then the companies faced a shortage of cars and drivers. The situation has improved over time, with the assistance of the Ministry of Infrastructure, and today there is no major problem with transportation by road.

Regarding rail transportation, container lines faced a lack of scheduled trains from Constanta. But there were other technical problems, such as different track widths in Ukraine and Europe. Despite this, a solution was found. Thus, the Western Terminal launched a regular train from Ternopil to Constanta - which helped to export many containers, especially those with critical imports and necessities.

The next problem arose during the load transfer in the port of Constanta which does not have enough capacity, so it faces overloading. For example, the ‘’DP World’’ terminal is 80% overloaded and for the last several weeks, companies have been trying to solve this problem. Also, the situation worsened due to the intense workload of the customs service. However, there is hope, as the EBA member companies continue to look for possible alternatives and work despite all the above difficulties.

“We work with different partners to provide alternative ways. Therefore, we have identified several terminals, and most of them are in Western Ukraine, including Ternopil. We also partially use the port of Izmail with a barge service in Constanta and we are considering access to the port of Trieste on the Adriatic Sea. In this way, we connect logistics from the port of Odesa via Slovakia or Hungary and now have many export containers to deliver to recipients. We also see that soon there will be a lack of railway infrastructure, namely regular trains to Gdansk, Gdynia, and Constanta. As for exports, there are problems with a lack of equipment for export as container imports have fallen sharply. We see great demand for agricultural exports, but the number of containers in circulation is not enough to ensure normal exports from Ukraine. We are also considering the launch of new import bookings with the head office to increase the number of imports from Ukraine and provide this opportunity to our customers. So, it comes back to the challenges of the first days: a very large volume of imports was unloaded in other ports around the world. After all, at that time, customers could not understand what to do with these goods. Secondly, there were very high costs for redirecting these goods to other countries," - said Rachid Bouda, Member of the EBA Odesa Coordinating Council, and General Director of MSC Ukraine.

Artur Nitsevych, Chairman of the EBA Odesa Legal Committee, Interlegal Partner, commented that over the years, our Ukrainian clients have become accustomed to the super flexibility and loyalty of logistics market participants. For comparison, if we take the example of the port of Constanta, the reality is different in terms of deposits, customs formalities, prompt processing of requests, etc.

Grain logistics: major changes and market newsÂ

According to Ukrzaliznytsia's statistics, as more than 80 manufacturing companies in Ukraine ceased operations with the start of the war, domestic rail freight also stopped. The second blow to the railway industry was the blockade of seaports. There are only four ports left now, namely Ust-Danube, Kiliya, Izmail, and Reni. However, they provide only one-tenth of the pre-war transshipment capacity. Therefore, they lost foreign traffic too.

Reni and Izmail ports are the busiest, but to get to the port of Izmail you need to cross through Moldova. There are also delays in the ports due to the arrhythmic load on the Reni. Port terminals simply do not cope with the load. And to get to Izmail by rail you need to cross the Dniester Bridge, which has been damaged by the aggressor for the fifth time. However, Ukrzaliznytsia is working hard to load our ports with goods by rail. Possible alternatives include the use of border crossings. There are 13 of them, including 4 with Poland, 2 with Slovakia, 2 with Hungary, 3 with Romania, and 2 crossings with Moldova, which currently carry a total of 3-4 million tons of cargo at the junctions. In terms of the connection capacity, Poland comes first, Slovakia – second, and Hungary – third. If we talk about agricultural products then in April, Ukrzaliznytsia reached a volume of 640-650 thousand tons per month.

According to Valery Tkachev, Deputy Director of the Commercial Work Department of Ukrzaliznytsia, the company unevenly uses the available border crossings. As a rule, they chose those border crossings, where historically there was a large volume of traffic. Therefore, the task arises for businesses to build new logistics chains as soon as possible and make the most efficient use of all existing border crossings. On the part of Ukrzaliznytsia, there is a sufficient locomotive and car fleet to bring export cargoes to the border, and further everything depends on the readiness of foreign carriers to deliver these cargoes. Also, the problem with bureaucratic procedures complicates the situation. These include customs controls, phytosanitary, and veterinary checks (done on both sides of the border). Much work is being done at the legislative level to address this issue.

Currently, grain cargo is transported mainly through the western border crossings – the largest amount goes through Izmail, Vadul-Siret (Romania), and others. Unfortunately, the railway infrastructure can only transport limited quantities of goods from Ukraine to the EU. Systematic work is needed to increase the capacity of border crossings in accordance with the needs of the economy. We talk about developing the existing terminals, constructing new ones, creating mobile transshipment points, increasing the number of narrow-gauge trucks, attracting an additional fleet of carriers on the narrow passages, simplifying border crossing procedures, and others.

Mykola Gorbachev, Director of Soufflet Group in Ukraine, and the President of UZA, spoke in more detail about the changes in Ukrainian grain exports and the importance of unblocking Black Sea ports.

According to him, the war adjusted Ukraine's export opportunities. After all, in the pre-war period, about 6 million tons per month could be exported through the Black Sea ports. And now, due to railway crossings and the Danube, our exports are just over 1 million tons, so it has decreased 6 times. As for alternative export options, which Ukraine is working on together with Poland and the Baltic countries, they will not significantly increase exports. After all, the architecture of Europe is built on other principles. There is a lack of floating cranes, berths are not designed for such traffic. Therefore, it is extremely important to reconsider industrial trade. It must now be to bring the maximum amount of goods to Europe to the final consumer. Besides, due to the communication with the Ministry of Economy and the Ministry of Agrarian Policy and based on the recommendations written by EBA and UZA, the effectiveness of those decisions made in wartime is increased.

Realizing the threat of food shortages in the global market, as well as the importance of grain exports for Ukraine's economy; our international partners are trying to help us. Thus, the EU is developing its plan to support grain exports, which aims to eliminate bureaucratic and technical problems that arise on the border with EU countries while exporting grain from Ukraine. As for the unblocking of ports, the grain industry does not expect this until the end of 2022, although the issue is already being actively discussed at all levels. The only correct way out is to provide an international convoy and unblock Ukrainian ports.

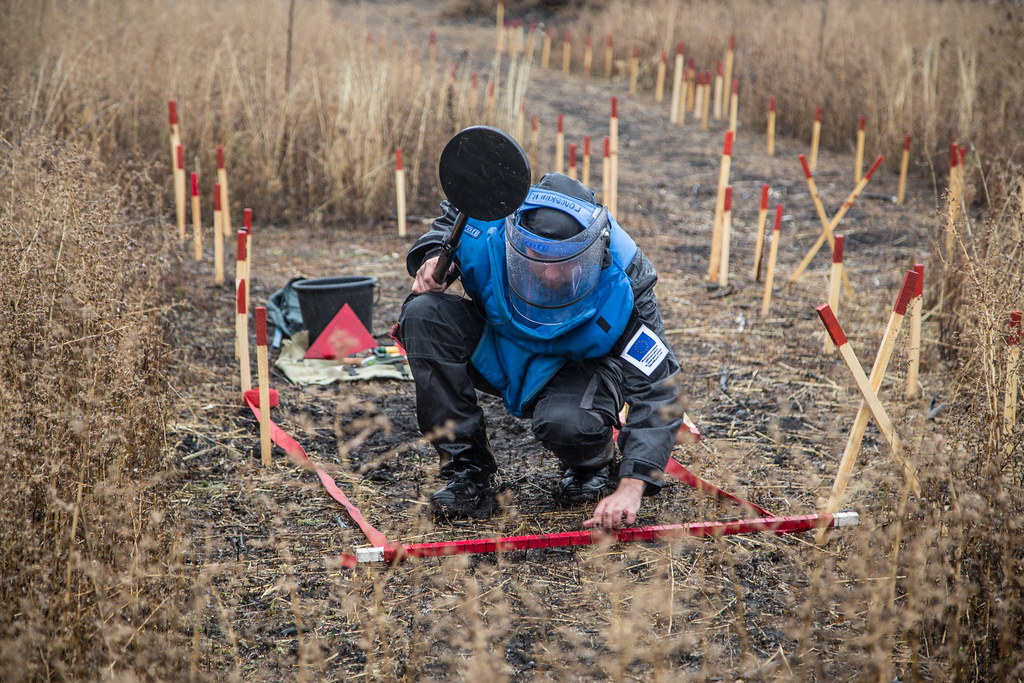

Mr. Nitsevych noted that back in April, the issue of the possible opening of Ukrainian ports was not on the agenda at all, but now, we can say, the situation has changed radically. The United Nations, the International Maritime Organization, the United Nations World Food Program, and the European Union are all involved in its discussion. We see daily news and opportunities for political influence and coercion, so to speak, to engage in dialogue on this issue. But no one can give an accurate forecast of when this will happen. Besides, Philip Sweens, Managing Director, HHLA International GmbH, spoke at the recent EBA meeting that the ports would likely remain unblocked by the end of 2022. After all, there is also the issue of maritime safety, so it is important who will take responsibility for demining the sea and for naval convoys as Ukraine cannot do it on its own.

What are the problems with cargo going to Ukraine and with cargo that cannot be taken out of Ukraine? Â

Karina Gorovaya, Senior Lawyer at Interlegal, the Attorney at Law, spoke in more detail about that. Thus, problems with cargo going to or from Ukraine can be parted into two – those associated with logistics, and those with the adoption of some restrictive regulations. In the first days of the invasion, access to Ukrainian ports was banned, and cargo flows were diverted to other ports in Romania and Turkey, whose facilities were not ready for this. That caused delays in customs clearance of goods and increased storage rates. Moreover, each country has its local regulation of the procedure for issuing cargo and registering transit cargo, which may differ from what was effective in Ukraine. As a result, in some cases there was a need to reissue bills of lading, to change consignees to local logistics agents with whom no cooperation had previously been established. Even after a few months, there are complaints from freight forwarders about the non-transparent policy of line pricing and billing with rates for unclear services. There were some complaints about the efficiency of carriers' agents in ports. For example, it now takes several weeks to change the destination port. All this time, cargo owners are forced to pay for storage.

Also in mid-March, the Commander-in-Chief of the Armed Forces of Ukraine issued an Order on the forcible alienation of property (cargo) of certain legal entities that are stored in container terminals. This caused concern for both terminals and freight forwarders who placed cargo there. The procedure is legal under martial law but still, the task of both freight forwarders and terminals is to protect themselves from possible claims of cargo owners and make sure to comply with the procedure of alienation.

Legislative restrictions complicating export and import processes have resulted in new import/export rules. On February 29, the Cabinet of Ministers of Ukraine adopted the Resolution approving the list of exported goods that are subject to licensing and quotas. There are goods with zero quotas that is equivalent to a ban on the export of several agricultural goods. These are oats, buckwheat, sugar, salt, as well as some types of fertilizers. Several goods require licenses to be exported. Also, restrictions on foreign currency settlements affect the ability to import goods, except for critical imports.Â

To summarise, Ukraine continues to increase its ability to export goods by land so that the trade with international partners can be resumed while the russian occupiers block the sea. After all, the only way out is to find alternatives in the current circumstances and, despite the war, to support and stimulate Ukraine's economy.Â