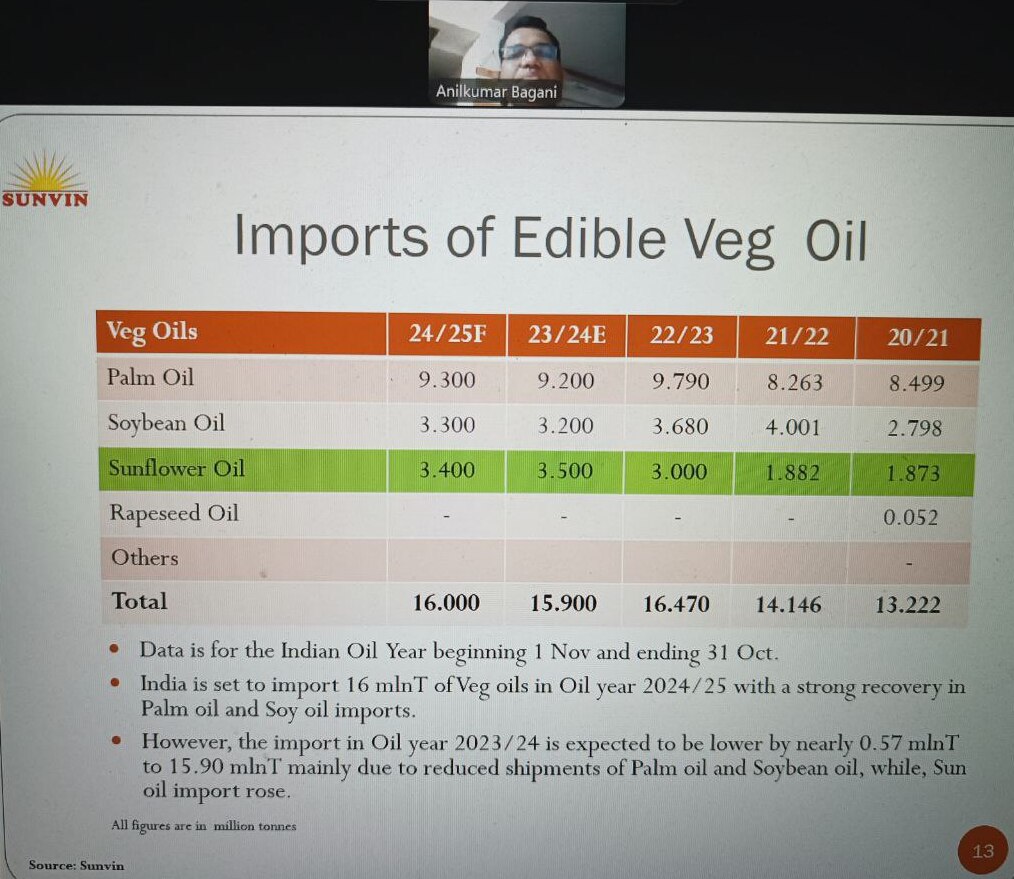

In the 2024/25 marketing year, India plans to rely less on Ukrainian sunflower oil and increase purchases of oils from other origins.

Anilkumar Bagani, head of commodity market research at Sunvin Group India, shared this forecast during an online conference hosted by Trend & Hedge Club, according to ASAPagri.

"We forecast import of crude sunflower oil in India at 3.4 MMT in 2024/25 MY, down from 3.5 MMT in 2023/24 MY. For reaching this target, we will need to look for russian, Argentinian and maybe European sunflower oil rather than Ukrainian. Ukraine has suffered from heat wave that has hurt the yields. The sunflower crop here will be about 12.5 MMT, and the oil content will be down," Bagani explained.

Sunvin Group forecasts that the import of crude palm oil into India will reach 9.3 million tons in the 2024/25 marketing year, up from 9.2 million tons in the previous season.

Bagani noted that India will face challenges in importing crude palm oil due to Indonesia’s policy, which aims to boost exports of processed products rather than crude palm oil.

"This is related to the increase in palm oil processing capacities in Indonesia. This is a problem for India, which imports crude oil and processes it domestically," he added.

For soybean oil, the import forecast for the 2024/25 marketing year is 3.3 million tons, compared to 3.2 million tons in the previous season.

"This year, Argentina will almost double its soybean harvest. Therefore, there will be enough soybean oil from Argentina. However, this is not the case for Brazil, as it consumes more soybean oil due to its biodiesel policies. As a result, they have about 1.6-1.7 million tons of soybean oil export potential this season," concluded Anilkumar Bagani.