By Max Gardus

The sanctions announced on October 22 by the Donald Trump administration against Russian oil companies represent Washington’s toughest step in this sector over the past two years. The U.S. Department of the Treasury blacklisted the state corporation Rosneft, the private holding Lukoil, and more than thirty of their subsidiaries.

The measures target not only production but also logistical chains – those that ensure extraction, transportation, and maritime export of crude oil, effectively hitting the financial lifeline of the Russian budget.

Among the companies affected are Lukoil Perm LLC, Lukoil West Siberia LLC, and Lukoil Kaliningradmorneft – three key subsidiaries responsible for oil production in Russia’s main basins. Together, they process over 40 million tons of crude annually, or roughly 15% of Russia’s total production. The sanctions list also includes the Kuibyshev Oil Refinery, which has a capacity of over 7 million tons and supplies fuel to central Russia, as well as Rosnefteflot and Prime Shipping – tanker fleet operators controlling oil shipments via Novorossiysk, Primorsk, and Kaliningrad.

According to Razom We Stand partners and CREA analysts, these companies account for about a third of Russia’s maritime oil shipments, providing the Kremlin with at least $1.5–2 billion in revenue per month.

The market reaction was immediate. On the Moscow Exchange, Lukoil shares fell 3.4% and Rosneft 4.1% within the first hours after the announcement. The MOEX index dropped nearly 1.7%, and the combined market capitalization of both companies declined by over $12 billion.

Brokers at Finam and BCS note that the short-term volatility is primarily due to fears of possible blocking of dollar transactions, loss of insurance coverage from international P&I Clubs, and increased tanker freight costs.

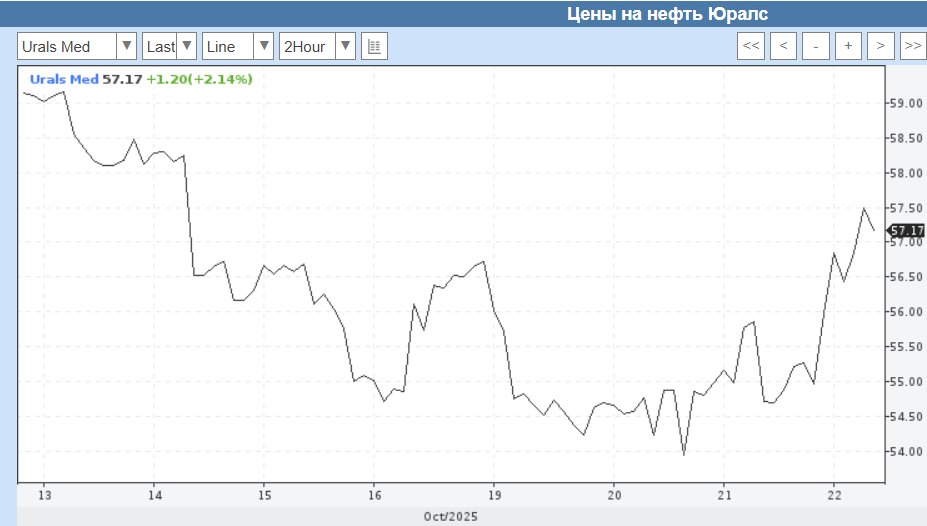

Globally, however, the sanctions triggered a different reaction – oil prices jumped sharply. By the evening of October 22, Brent rose 4% to $64 per barrel, and WTI climbed to $60.65. This was the largest daily increase in the past two months. Experts explain this “anticipation effect”: traders price in the risk of reduced Russian supply, even if physical export volumes have not yet changed.

At the same time, the price of Urals, Russia’s main crude grade, has increased only slightly, from $54 to $57, as seen on the chart.

According to the International Energy Agency, Russia currently exports around 7.2 million barrels per day, or about 10% of global exports, and even a slight reduction in this flow could significantly raise prices.

The long-term consequences for Russian companies look far more serious. The new restrictions mean losing access to most Western financial instruments and technological services.

This is particularly notable because over the three years of war, the American oil service company SLB (formerly Schlumberger) has not only remained in Russia but even expanded its operations, despite efforts from NGOs (Business 4 Ukraine), diplomats, and individual U.S. Congress members.

SLB is a leading global supplier of horizontal and hydraulic fracturing (fracking) and directional drilling technologies, which allow for increased well output and development of hard-to-recover reservoirs, particularly in Western Siberia and the Arctic, where natural reservoir pressure is low.

The company also provides digital geophysical modeling and field monitoring services – software suites Petrel, Techlog, and DELFI – which enable 3D reservoir modeling, optimal drilling point selection, and real-time process management. SLB supplies pump-compressor equipment, cementing systems, logging tools, and enhanced oil recovery technologies, all essential for maintaining stable production at mature fields.

Crucially, SLB possesses unique technologies for offshore and Arctic operations, including autonomous underwater drilling modules and pressure monitoring systems – capabilities that Russian companies cannot replicate on their own.

Even partial SLB presence in Russia has effectively preserved a “technological oxygen supply” for the industry. The author personally hopes that SLB will finally exit Russia.

The ban on transactions via U.S. banks blocks dollar settlements, and refusal by insurance clubs to cover Russian tankers could increase transport costs by $15–25 per ton. However, the situation is not straightforward – dollars have long been bypassed in transactions with China and India, and insurance is often provided outside Western companies.

Oxford Energy Institute analysts estimate that even partial blocking of financial and logistical channels could reduce Russia’s oil revenues by $80–100 million per day, or roughly $30–35 billion per year. For comparison, in 2024, oil and gas exports brought the Russian budget about $240 billion, or 38% of all state revenues.

More cautious Russian economists estimate direct logistical losses at $5–7 billion per year, but acknowledge the real figure could be higher if the EU and the UK align their sanctions lists with the U.S.

Despite the high-profile nature of the decision, experts in both the U.S. and Europe recognize its limited impact. Rosneft and Lukoil no longer have direct contracts with U.S. counterparties, and most of their export deals are handled through banks in China, India, the UAE, and Turkey. Without secondary sanctions targeting buyers of Russian oil – primarily Indian and Chinese refiners – the new restrictions are more a political signal than an economic blow.

At the same time, the sanctions’ effect is mixed. On one hand, potential sales reductions could gradually limit Russia’s export revenues, especially if secondary sanctions complicate logistics for the “shadow fleet.” On the other hand, the already rising oil prices could partially or fully offset losses in physical export volumes.

Bloomberg Energy Intelligence calculates that a $4 increase in the Brent average price, with current export volumes maintained, would generate an additional $28 million per day for Russia – an amount that could neutralize the initial short-term impact of the sanctions.

Thus, Washington’s move is more of a warning gesture, signaling U.S. readiness to resume a more active sanctions policy in the energy sector. The real impact will only be felt if the United States can persuade its allies to join the restrictions and also implement oversight over buyers of Russian oil outside the G7. Otherwise, the new sanctions risk remaining a symbolic reminder that Russia’s financial and logistical isolation is far from complete.