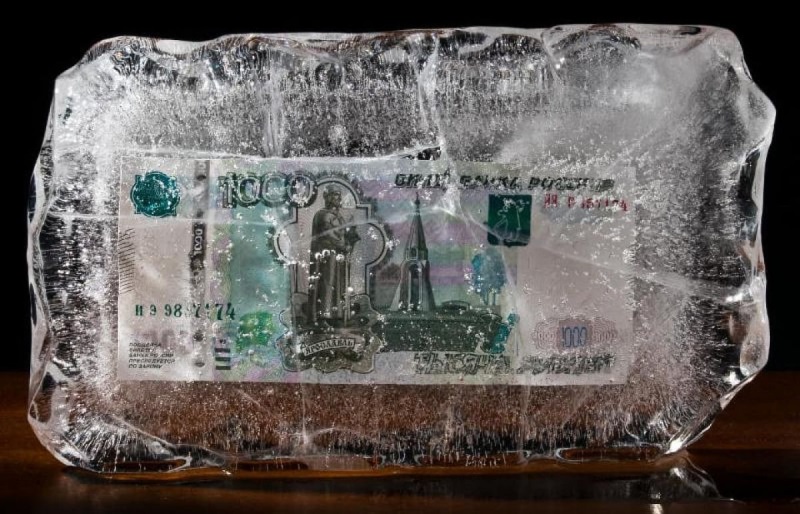

Ahead of the Central Bank of Russia's meeting on February 14, there is active discussion in Russia about the possibility of "freezing" individual deposits.

The declared goal is to curb inflation in case of a reduction in the key interest rate. However, the main reason behind it is the need to free up additional funds to continue financing the war against Ukraine.

The head of the Central Bank of Russia, Elvira Nabiullina, has instructed a commission composed of representatives from three departments of the regulator to explore the possibility and consequences of such a decision. They are particularly concerned about undermining depositors' trust in banks, triggering a sharp outflow of funds during the negotiation of this initiative, and leading to a liquidity crisis—the reduction in the ability of financial institutions to meet their credit and financial obligations.

The Central Bank's discussion of the topic of "freezing" deposits also suggests an attempt by the Kremlin to gauge public opinion and prepare the population for such a decision, as, given the Russian-Ukrainian war and the strict sanctions imposed by the West, such a move is likely to lead to widespread dissatisfaction and potential protest actions.