One of the world's largest investment firms, Fidelity, has identified Bitcoin reserves as a driver of the cryptocurrency market. Ukraine is among the top countries in terms of Bitcoin holdings at the state level, alongside the United States, the United Kingdom, and China, writes PaySpace. This underscores Ukraine's strategic approach to financial innovation and its role in global trends for 2025.

According to Fidelity's analytical study, the approval and launch of spot Bitcoin ETPs (exchange-traded products) in early 2024 led to a significant increase in demand for BTC access among institutional and retail investors. This regulated, transparent, and accessible instrument has made investing in Bitcoin easier than ever. This trend is expected to accelerate in 2025.

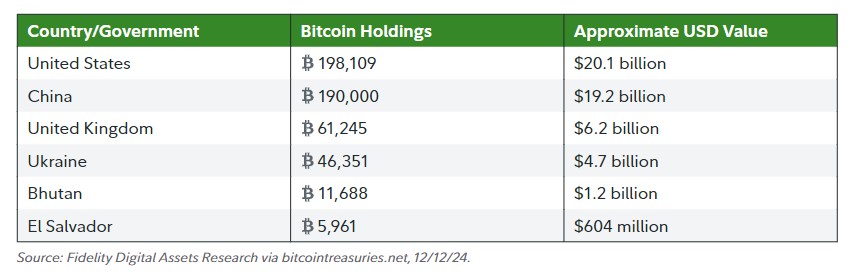

One of the most notable developments today is the emergence of governments and states into the scene. The largest Bitcoin holders among governments today include the USA, China, the UK, Ukraine, Bhutan, and El Salvador. However, despite holding BTC, many countries acquired this asset mainly through confiscations and the return of funds related to illegal activities, rather than as part of a strategic long-term position. Furthermore, some governments, such as the USA, have specific requirements regarding how to handle or auction off this crypto asset, meaning they cannot count it as part of their national reserves.

"We expect 2025 to be the year this changes for both acceptance and adoption. This is to say, we anticipate more nation-states, central banks, sovereign wealth funds, and government treasuries will look to establish strategic positions in bitcoin. Perhaps these establishments will take notice of the playbook employed by Bhutan and El Salvador, and the substantial returns they have been able to glean from such positions in a relatively short amount of time," says Matt Hogan, co-author of the "Building on Bitcoin" study and analyst at Fidelity Digital Assets.

According to him, amid challenges such as high inflation, currency devaluation, and increasing fiscal deficits, not investing in BTC may become a greater risk for countries than holding it. U.S. President-elect Donald Trump and Senator Cynthia Lummis have repeatedly expressed their support for creating a Bitcoin strategic reserve in the U.S. However, it remains to be seen whether they will implement this ambition in 2025.

"Senator Lummis introduced the Bitcoin Act of 2024 to the Senate in July of 2024.38 If the bill is enacted, we believe the political and financial game theory at play will force other nations to follow suit. However, if this strategy were to be adopted, it is likely that nation-states would begin accumulating in secret. This is because no nation has an incentive to announce these plans, as doing so could influence more buyers and drive up the price. While it remains to be seen if this strategy will be implemented in 2025, those who would potentially adopt it will be incentivized to do so covertly."