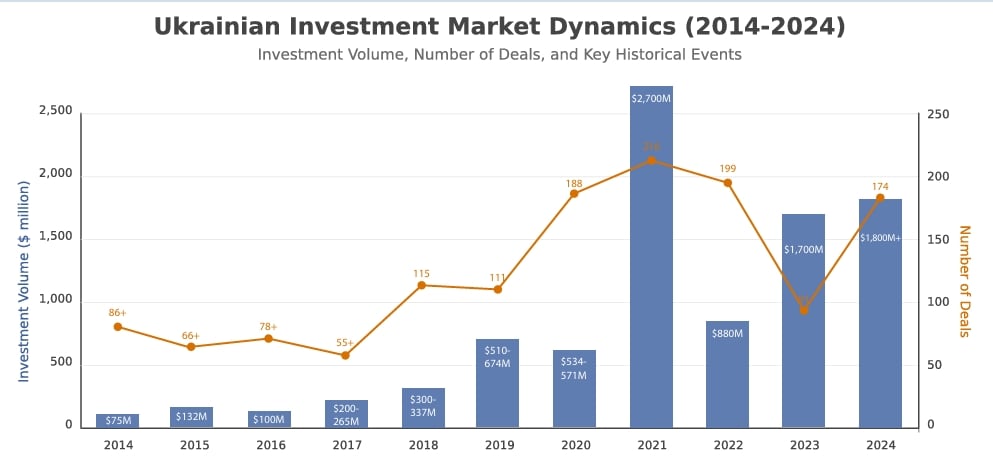

The number of investment deals in the Ukrainian market in 2024 rose to 174 compared to 91 the previous year, according to data from the Ukrainian Venture Capital and Private Equity Association (UVCA) in their review "A Decade Retrospective of Ukraine’s Investment Landscape."

“Further recovery of the investment market. The ‘deal of the decade’ was closed with a total investment volume exceeding $1 billion (Lifecell + DATA Group + Volia). Deals in the defense technology sector play a key role in venture transactions,” the report highlights as key events of the past year.

According to UVCA, in 2023-2024, Ukraine’s investment market entered a phase of adaptation and recovery: the number of deals is increasing, but the average deal size is smaller.

According to the association’s data, the total deal volume in 2024 increased less significantly than the number of deals — from $1.7 billion to over $1.8 billion.

According to the review, the best, peak year for the Ukrainian investment market remains the pre-war 2021 — with 216 deals totaling $2.7 billion, including major deals in IT, energy, and agriculture. Over the period from 2014 to 2024, more than 1,400 deals were concluded with a total volume of $8.8–9.2 billion, the review states.

“Despite challenges, Ukraine’s investment ecosystem remains resilient. We continue to observe adaptability among startups, growing focus on innovation, and increasing interest from international investors, especially in high-potential sectors such as renewable energy, defense technologies, and artificial intelligence. Of course, access to capital remains a key challenge, and restoring investor confidence is something we all must work on together,” said John Patton, founding partner of Argentem Creek Partners and head of the EMEA & Asia region, cited in the review.

The company declares it has invested over $600 million in Ukraine over the years in logistics, agriculture, metallurgy, and mining industries.

It is noted that during the described decade, Ukraine’s investment ecosystem lacked institutional lead partners (LPs) — two compared to an average of five for Central and Eastern European (CEE) countries — and experienced limited interest from regional and global funds, resulting in insufficient investment in Ukraine. As a result, the country has significantly fewer active fund managers relative to GDP compared to regional benchmarks, mainly due to a lack of accessible institutional capital for local private equity (PE) players and limited presence of regional and global funds.

At the same time, after the start of the full-scale Russian aggression, many local teams remained active and now attract Ukraine-focused private equity funds. Ukrainian PE funds follow diversified strategies across several industries, covering not only technology but also agriculture and food processing, infrastructure, green energy, industry, and other sectors crucial for Ukraine’s reconstruction and economic development, the review notes.

According to the review, last year the share of domestic deals (both buyer and seller from Ukraine) increased to 53.1% from 51% the year before; deals with a Ukrainian buyer and foreign seller rose to 20.4% from 12.8%; while deals with a foreign buyer and Ukrainian seller fell to 26.5% from 36.2%.

Overall, during the war period, the share of domestic investments (by number of deals) grew to 55% from 40% in 2014-2021, while investments from both the US and EU decreased to 17% from 22%, and from other countries dropped to 11% from 16%.

Regarding sectoral distribution, it is reported that after the full-scale Russian invasion in 2022, there was a sharp increase in investments in defense technologies (drones, communication systems, cybersecurity, military management software, etc.), as well as heightened attention to energy security — growth in investments in renewable energy sources, energy storage systems, and gas production.

Additionally, there remained sustained interest in the agricultural sector, which continued to attract investment but with a focus on logistics, processing, and exports, while other sectors saw a decline in activity: investments in real estate, retail, and other non-critical sectors fell.

As examples, UVCA cites deals with Swarmer, BAVOVNA, Himera Radios, Buntar Aerospace (all MilTech), DTEK projects, OKKO Group wind energy projects, and Dragon Capital investments in peak gas and battery energy storage systems.

The association adds that exact figures for investments in MilTech are difficult to estimate due to the non-public nature of many deals, but some estimates put them above $200 million in 2022-2024.

“Despite the war, the IT sector has maintained its attractiveness and served as a refuge for some investments. Examples include deals with Grammarly, Creatio, Allset, and acquisitions of Ukrainian IT companies by foreign firms (such as Intellias Digitally Inspired),” the review also states.

According to it, the share of deals (by amount) in IT and telecom in 2022-2024 decreased to 35% from 46% in 2021, in agriculture to 12.5% from 17.6%, while in energy it increased to 17.6% from 7.5%, in MilTech from 0.5% to 8%, and in construction and real estate remained at 12.5%, as in other sectors.

UVCA is a non-profit organization headquartered in Kyiv, Ukraine, with offices in the EU (Warsaw, Brussels) and the USA (Washington). It was founded in 2014 by seven members and now has more than 50 participants. The UVCA supervisory board is chaired by managing partner of AVentures Capital Andriy Kolodyuk, and the CEO is Dmytro Kuzmenko.