Russia is facing growing challenges in substituting industrial software (IS) with domestic solutions. As of 2024, 837 software needs have been identified in the Russian economy, where no local analogs exist, or they require significant refinement.

Key issues include high development costs for Russian software, low competitiveness, a lack of experience among Russian developers in creating robust software for high-tech industries, and a shortage of qualified personnel.

In December 2023, the 12th package of sanctions against Russia was adopted, prohibiting the supply, sale, transfer, and export of enterprise management software to the country. On September 12, 2024, the U.S. sanctions package came into effect, banning American companies from providing IT consulting and project services to Russian clients.

The most significant software needs in Russia are recorded in:

- Agriculture: 172 needs, with no Russian solutions for 159 of them.

- Automotive industry: 101 needs, including 56 unmet by local solutions.

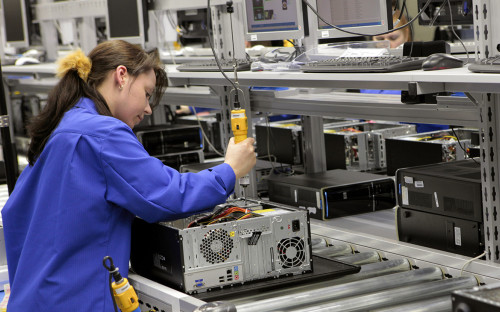

- Electronics and microelectronics: 47 needs, with no Russian analogs for 35.

- General machinery: 62 needs, 14 of which lack domestic alternatives.

As a result, over 98% of projects in the metallurgy, chemical, and energy industries rely on foreign software.

Given limited access to Western technologies and the inability to develop reliable software domestically, Russia’s dependence on imports from "friendly" countries, particularly China, is expected to grow further.