If the People's Bank of China continues to dump U.S. Treasuries and shift reserves into gold, the price of the precious metal will skyrocket.

Gold futures have already reached a historic high of $3,300 per ounce.

Not long ago, China's portfolio included $1.4 trillion in Treasuries.

Now, it stands at $750 billion, and Beijing understands that in the event of an escalation in conflict, these assets will be frozen by Washington.

Therefore, the more intense the confrontation between the two superpowers becomes, the higher gold will rise and Treasuries will fall.

For now, China has not fully liquidated its U.S. bond portfolio.

However, in order to avoid a full collapse of U.S. bond prices, it will take 2-3 years to unwind the portfolio, almost until the end of Trump's term.

An interesting trend is emerging.

It could clearly become a catastrophe for Trump: a prolonged collapse of U.S. Treasury bonds lasting for years.

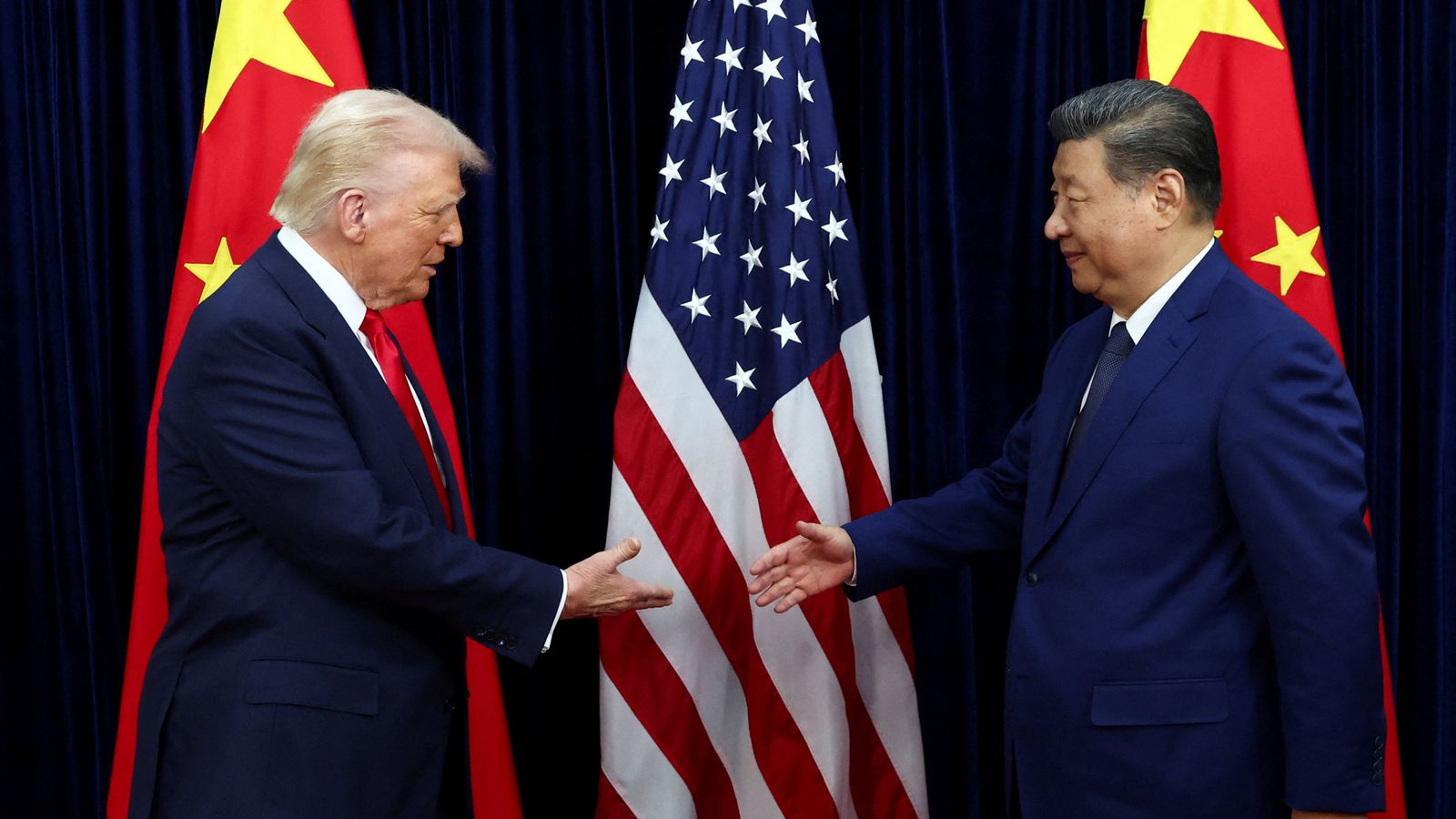

As a result, he will either have to make peace with China or catalyze the conflict.

But Trump rules out a real Great War, though he does not exclude sharp, single, radical actions, such as the elimination of Soleimani in Iran or a strike against Wagner PMC in Syria during his first term. Or threats toward North Korea.

However, in all three cases, the situation never escalated into a Great War with Russia in Syria, Iran, or North Korea.

Russia remained in Syria (and the downfall of Assad is now the work of Turkey and Israel).

Iran continued its nuclear program and created the Axis of Resistance against Israel.

And North Korea increased the number of nuclear warheads from one or two to a dozen, while also enhancing the technical parameters of their delivery systems.

But with China, "half-hearted" measures won't work. Even a draw would favor Beijing.

Here, it’s either win or lose.

Meanwhile, in March, China bought 3 tons of gold and 100 tons in the last year. Modestly, but with increasing momentum.

The U.S. financial market is meanwhile experiencing one of its most dramatic capital outflows—accelerating to a 5% decline, which in some ways mirrors the trend of 2022.

The year 2025, in terms of market behavior, may somewhat replicate the curve of 2022.

We look at the trend of 2022 and mentally project it into 2025.

And the history is similar—global instability, an increasing factor of uncertainty, and the risk of direct confrontation between two nuclear powers.

Back then, it was the U.S. and Russia; now, it's the U.S. and China.