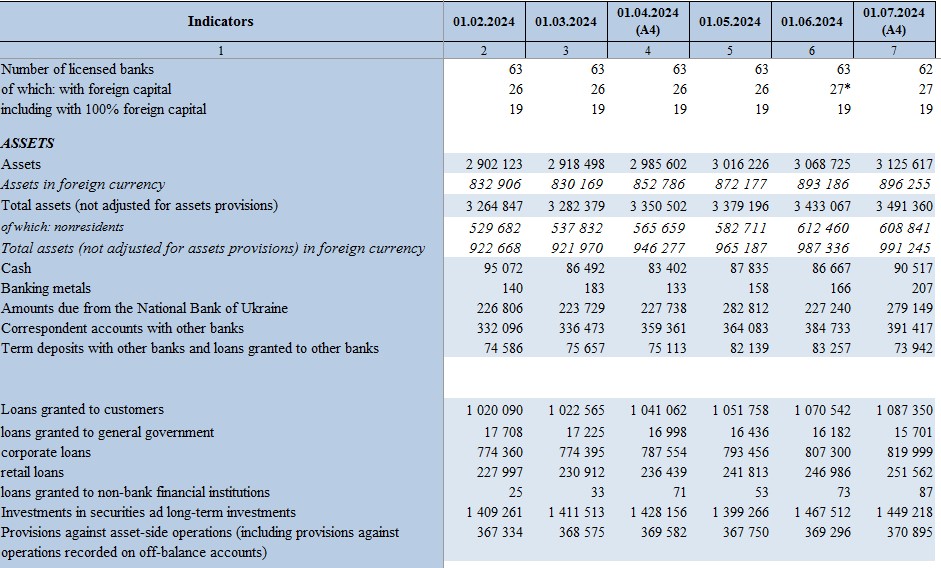

Net profit after taxation for solvent Ukrainian banks reached 79.0 billion hryvnias from January to June 2024, reflecting a 16.8% increase compared to the same period last year.

According to the National Bank of Ukraine (NBU), the main factors contributing to this profitability are the maintenance of a high net interest margin and nearly zero allocations to reserves for potential losses from active operations.

Bank revenues for the first half of 2024 increased by 18.1% to 204.5 billion hryvnias, with interest income rising by 22.0% to 171.9 billion hryvnias. Meanwhile, expenses grew by 18.7% to 168.7 billion hryvnias. Banks reduced their reserve allocations for future losses by 371 million hryvnias.

_1723633916.jpg/hKDkYbmFZeN9M962RG7aoseMwkLia1d1xZXFDL0p.jpg)

During the second quarter, the yield on major bank assets decreased, with the sharpest decline in the profitability of NBU deposit certificates. However, banks compensated for this by reducing their investments in these certificates. Market rates for government bonds and loans also decreased, yet their volumes increased. This expansion of assets allowed banks to maintain a relatively high net interest margin and increase their revenues.

Additionally, the NBU noted an increase in the amount of profit taxes accrued by banks, which amounted to 22 billion hryvnias for the first half of the year.

Out of 62 solvent banks, only seven small banks reported losses, with a combined loss of 171 million hryvnias.