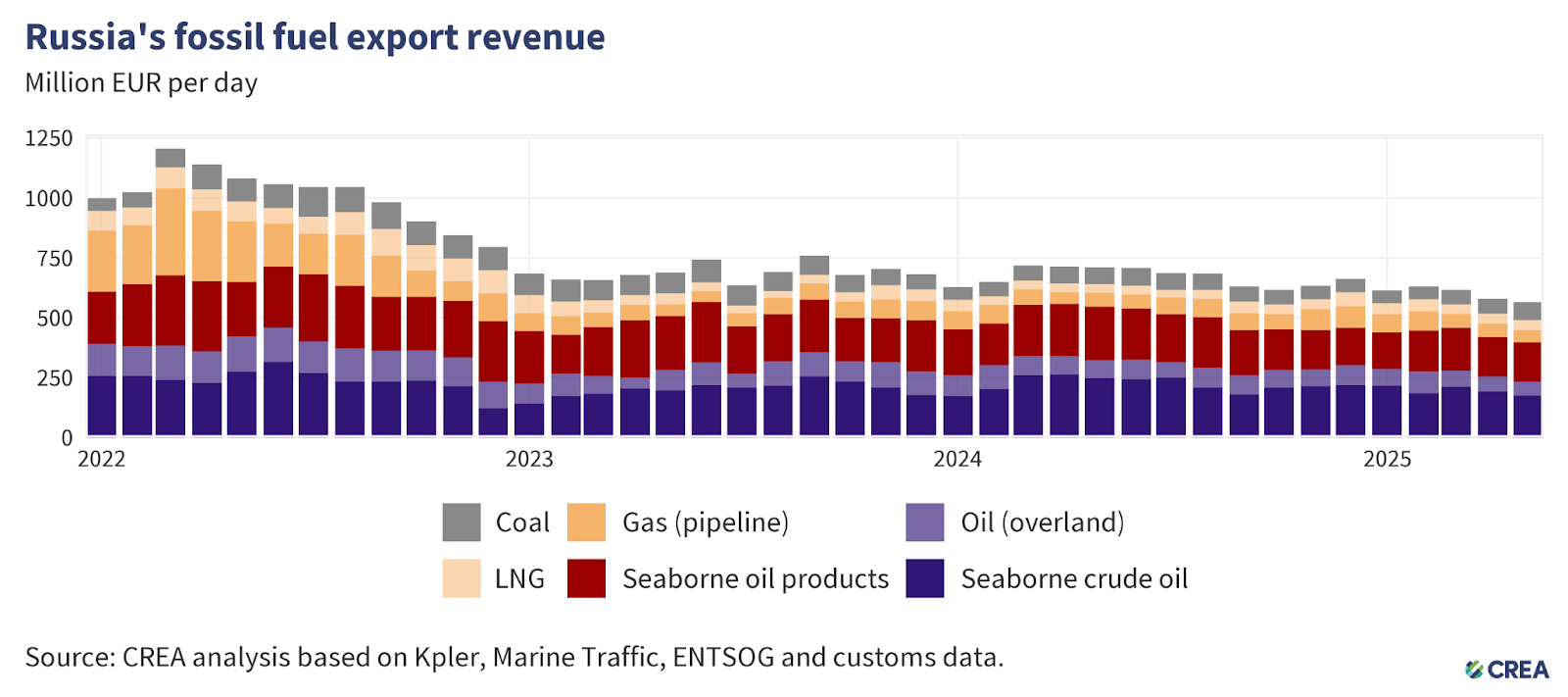

Export revenues of the Russian economy from selling hydrocarbons abroad in May 2025 dropped to a minimum since the beginning of the invasion of Ukraine, according to the monthly report by CREA (Center for Research on Energy and Clean Air).

According to their data, last month the daily export of oil, gas, petroleum products, and coal brought Russia €565 million. Compared to May 2024, the inflow of commodity currency decreased by 19%, and compared to the early months of the war — nearly halved, CREA’s calculations show.

Revenues from maritime oil exports fell 8% compared to April and 22% year-on-year — down to €176 million per day, the lowest level since January 2024. Although the physical volume of exports increased by 4% month-on-month, oil companies’ revenues were hit by falling prices: the Russian Urals grade averaged $57.3 per barrel versus nearly $70 at the start of the year.

Revenues from pipeline oil exports dropped 8% to €59 million per day. Gas revenues decreased by 7% compared to April — to €101 million daily. Of this, €51 million came from pipeline exports, and the remaining €40 million from LNG sales.

Revenues from petroleum product sales, according to CREA, remained unchanged at €101 million per day. At the same time, coal exports sharply increased: bringing in €74 million daily — 18% more than in April.

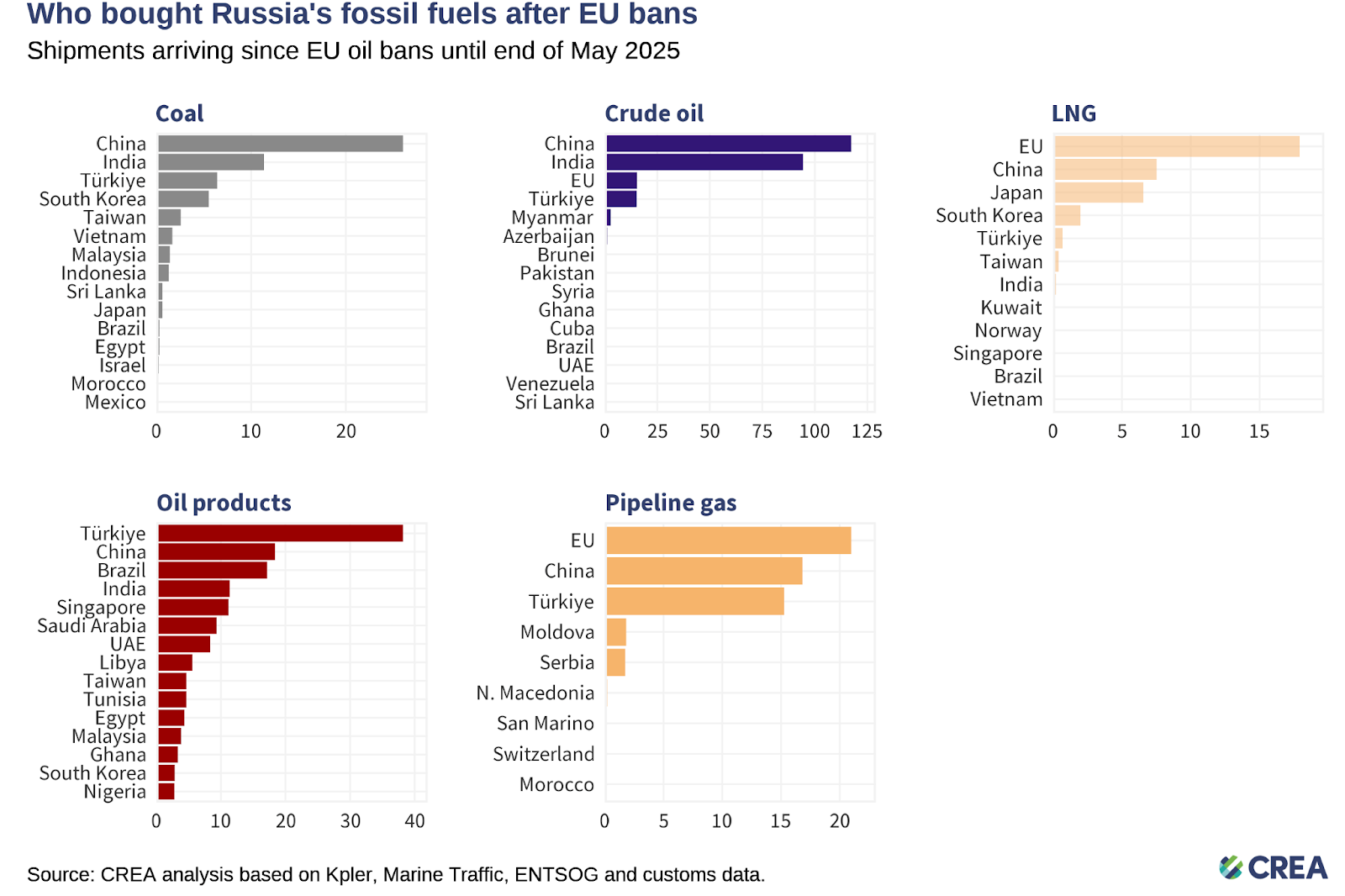

China remained Russia’s largest buyer of fossil fuels, CREA reports: it purchased hydrocarbons worth €5.7 billion over the month, with more than half of that being crude oil.

Supplies to India brought in €4.2 billion. Turkey remained the third largest buyer, purchasing hydrocarbons worth €1.8 billion, mostly petroleum products (€1.1 billion).

European Union countries bought Russian fuel worth €1 billion in May. Of this, 70% accounted for gas exports, and the remainder for oil, which Hungary and Slovakia continue to buy via the Druzhba pipeline.

A possible tightening of Western sanctions with a reduction of the price cap on Russian oil from $60 to $45 per barrel would cost Russia approximately 27% more in commodity revenues, or about €2.7 billion monthly, CREA estimates.

Currently, almost 40% of Russian oil is transported by Western tankers, the center’s experts note. They returned to shipping because Urals is sold below the price cap but would have to abandon this practice if sanctions become stricter.