There are several persistent myths that are particularly strong in Ukraine regarding China.

Myth number one. China will attack Russia because the Chinese dream of living in Siberia.

Spoiler: They do not dream of this. The population of the northern Chinese province of Heilongjiang, on the border with Russia, has been decreasing lately. For a Chinese person, it’s feng shui to live in southern China.

And China can now buy Siberian resources for fiat yuan, i.e., currency it prints itself.

Thanks to Western sanctions on Russia, China has entered the highest geopolitical "Ivy League," membership in which is determined by the right to purchase real material resources with fiat national currency.

Myth number two. There is no space for the large population in China.

In reality, China has vast territory, and a significant part of it is uninhabited due to harsh natural conditions (but it’s no worse than the cold pole in Yakutia).

In terms of rational and optimal use of territories, China is the world leader.

Myth number three. China faces overpopulation.

In reality, no: China’s population is declining and aging, which is becoming a demographic problem.

Myth number four. China still limits birth rates.

No. The "one family, one child" policy was long abolished. Now, China is actively encouraging birth rates.

Myth number five. China is entirely dependent on exports.

Exaggeration. China's GDP is up to $20 trillion, while its foreign trade turnover is up to $6 trillion. This means the ratio of trade turnover to GDP is around 30%.

For comparison, before the war, Ukraine's ratio was over 55%. That is real dependence.

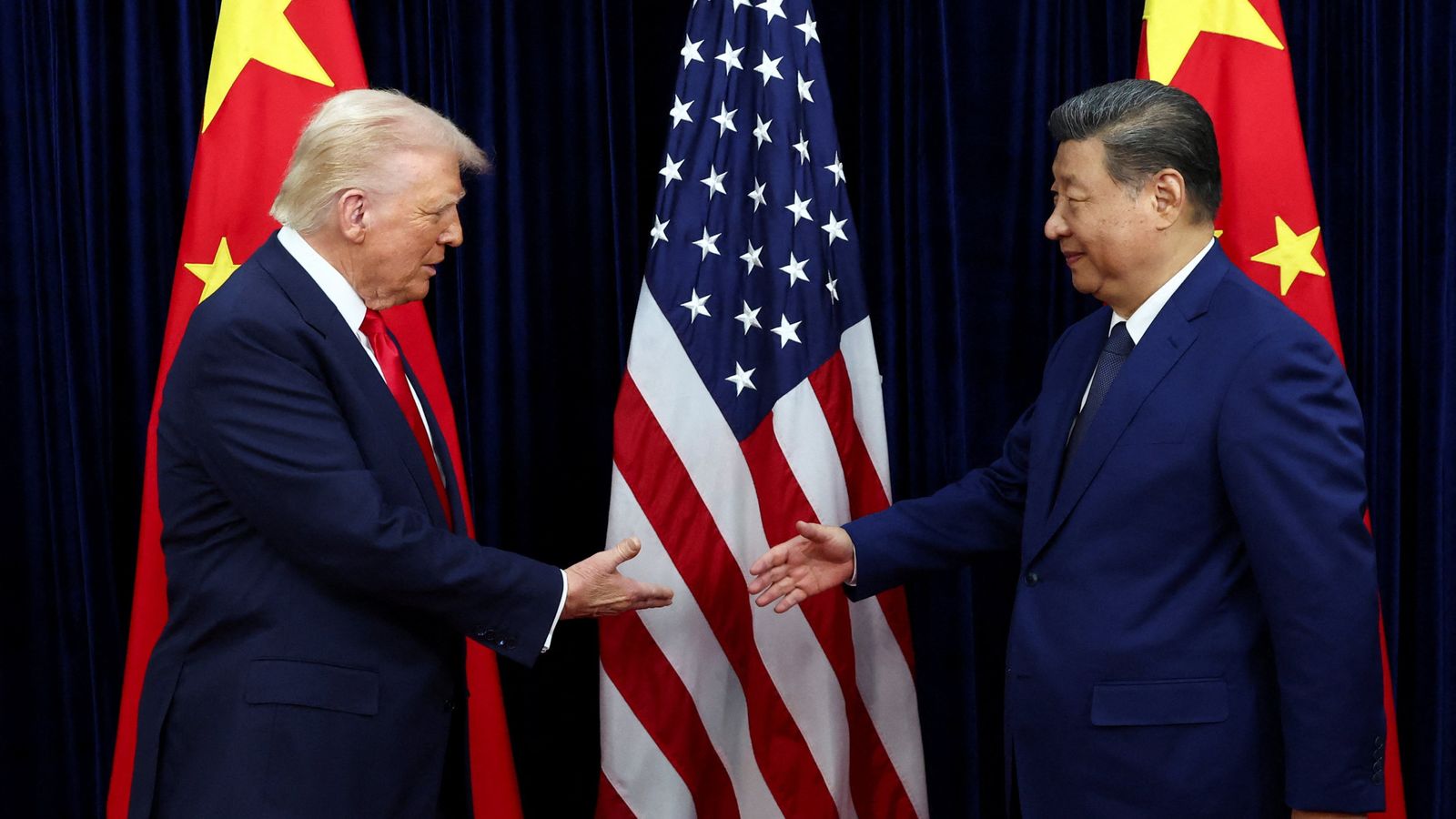

Even if all Chinese trade were destroyed, it would hurt China, but total collapse would not occur. This is why Trump is already talking about a "soft tariff policy" towards China.

And the final myth for today—China’s economy is focused on external investment as a growth factor.

For several years, I’ve been writing that China is shifting its export-oriented model, with an emphasis on investment growth, towards internal consumption.

With a middle class of 400 million people and more than 1 billion active consumers, China has more than enough to shift its growth driver from exports to domestic demand.

This is what the decisions of the Chinese Communist Party congresses indicate, and this can also be found in my articles.

Although the structural reorganization of China’s economy will be long and painful, with a slowdown in economic growth from 5%+ to 3-5% annually.

And my words were recently confirmed by the head of China’s Central Bank, Pan Gongsheng, at the Asian Financial Forum in Hong Kong:

"The priority of macroeconomic policy should shift from promoting investment growth, as in the past, to consumption along with investment."

To achieve this, China will create incentives for income growth through pension programs and social payments.

In this context, the key issue for growth, according to the head of the Chinese central bank, is: "insufficient domestic demand, particularly consumer demand."