Publication by Yegor Perelygin on Mining.com

On December 12, the submission period will close for Ukraine’s first-ever lithium production-sharing agreement at the “Dobra” site. This marks an important step in developing the country’s own critical minerals industry. Against this backdrop, it is crucial to assess Ukraine’s potential position in the global lithium market and determine the steps needed now to realize this potential.

The global lithium market is undergoing a profound transformation. Over the past five years, lithium has evolved from a material used in niche segments to a foundational metal for energy infrastructure. After a sharp price peak in 2022 and a decline in 2023–2024, the market is entering a new cycle.

According to the IEA (2025), global lithium demand is expected to grow from approximately 205 thousand tons in 2024 to over 928 thousand tons by 2040 — more than a fourfold increase.

The growth of electric mobility, energy storage systems, and related technologies is creating stable, long-term demand for lithium. IEA (2025) estimates that demand for this metal in the clean technology segment — primarily for electric vehicles and energy storage — will increase from 128 thousand tons in 2024 to over 369 thousand tons by 2030.

Trends are clear. This explains why the lithium extraction and processing industry is developing at unprecedented rates worldwide. However, despite a large number of announced projects, their potential is insufficient to fully meet future demand. In practice, actual production volumes are often lower than announced. The IEA’s review of key minerals (2025) shows that even if all currently announced lithium projects are launched, the Stated Policies Scenario (STEPS) indicates the world could face a shortfall of around 40% by 2035.

Another key factor is cost structure — the ability of producers to operate profitably even during periods of low prices. Some producers exit the market when prices fall, while those with low production costs and manageable debt continue to operate successfully.

Countries entering this sector must create conditions for projects with competitive production costs and modern processing technologies. For Ukraine, this means developing a model that allows the lithium industry to operate sustainably rather than speculatively. It also requires establishing effective investment conditions and encouraging the development of new industrial projects.

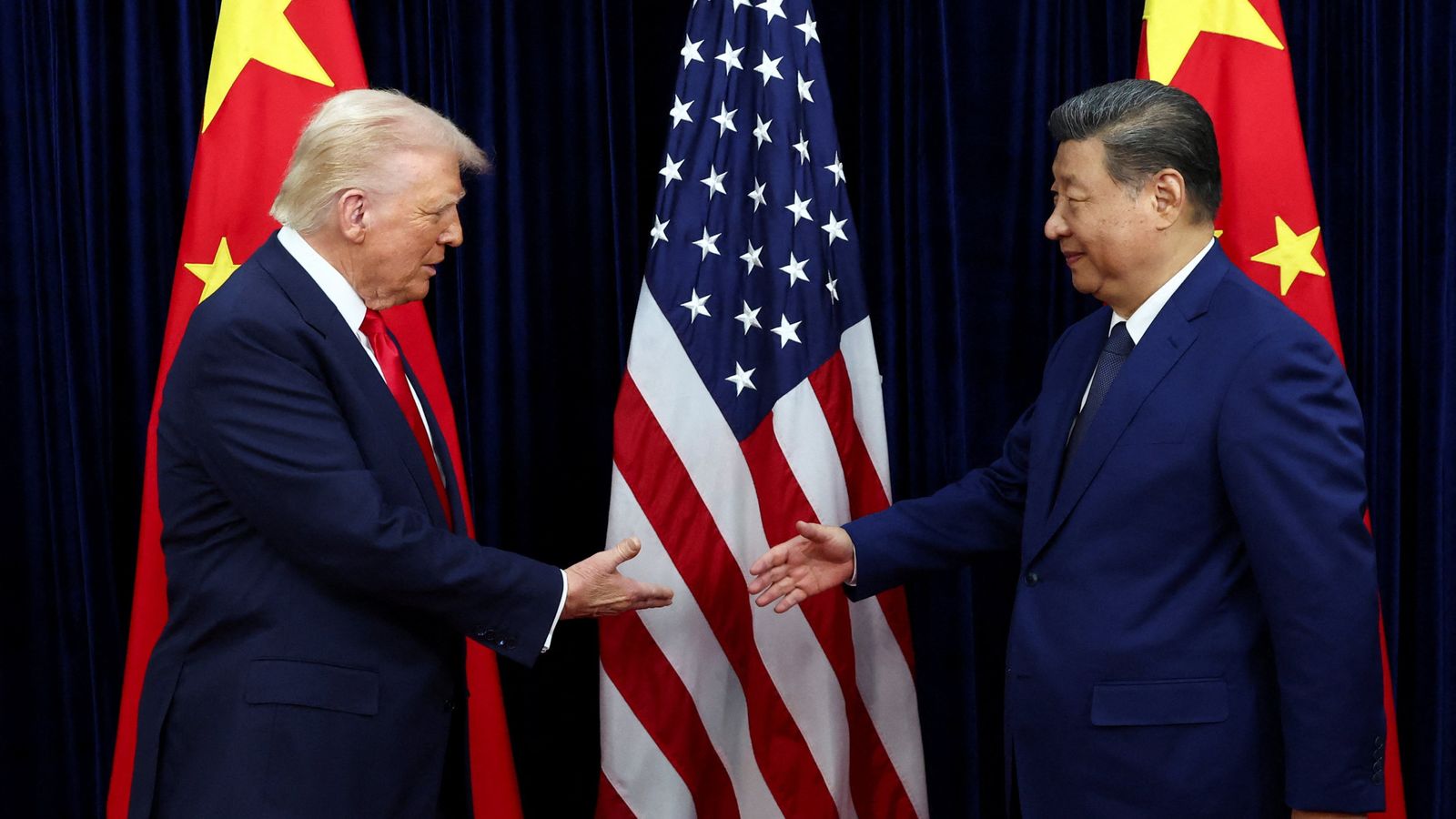

It is also important to consider the current market structure. Today, about two-thirds of global lithium processing capacity and over 70% of battery production are controlled by China. Consequently, global demand will also be driven by the need or desire of buyers to diversify supply sources. This creates opportunities for new market participants to secure their niche.

Ukraine has the potential not only to enter the market but also to achieve one of the most successful cases of entry worldwide. All prerequisites are in place.

The submission period for the first-ever lithium production-sharing agreement at the “Dobra” site ends on December 12. Ukraine can develop production based on hard lithium deposits and build a model with competitive costs, integrated into European industrial and technological supply chains.

To realize this potential, Ukraine must ensure competitive production costs, fast decision-making, technological development, and integration into Western supply chains.

Once licenses are issued and standards are met, lithium extraction and processing projects may be considered as candidates for financing through the American-Ukrainian Investment Fund for Reconstruction.

“Lithium is no longer a niche resource — it is becoming a metal of everyday use. This is not just about extraction; it is about the state’s ability to transform the resource into industrial capacity, technology, and export-ready products. For Ukraine, this is a chance to integrate into Western battery metal supply chains,” said Yegor Perelygin, Deputy Minister of Economy, Environment, and Agriculture.

Ukraine is entering a decade in which critical minerals will determine energy resilience, industrial development, and the growth of sectors transitioning to electrification. By combining its resource base with technology, investment, and rapid decision-making, Ukraine can strengthen its position in the new economy.