Despite the war, the investment climate in Ukraine is showing positive trends, according to the European Business Association.

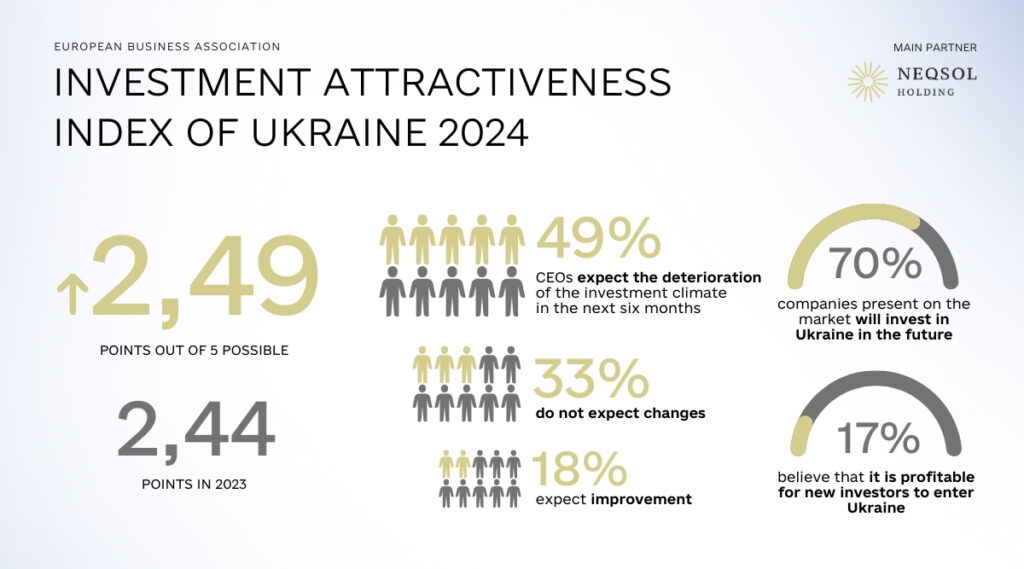

Data from a study by the EBA in partnership with NEQSOL Holding indicates that the Investment Attractiveness Index has risen from 2.44 in 2023 to 2.49 in 2024 (on a five-point scale). Although most entrepreneurs still find it unfavorable, this increase points to a growing confidence in the market.

The integral score of the Index slightly improved in 2024, reaching 2.49 out of 5 (compared to 2.44 in 2023). This overall rating is similar to the investment climate assessment during the “COVID year” of 2020.

The percentage of business leaders considering Ukraine’s investment climate as unfavourable has decreased from 84% last year to the current 79%, with 20% describing it as extremely unfavourable. Notably, this share has consistently decreased from 53% in 2022 to the current 20%. A neutral stance on the current investment climate was taken by 12% of top executives (up from 7% last year), while 9% view it favourably.

Perceptions of the investment climate dynamics remain unchanged from last year. Almost half of the respondents (49%) believe that the investment climate has worsened, 39% see no significant changes, and 12% think it has improved.

The proportion of companies already operating in the market and planning to continue investing, despite the war, increased from 57% last year to 70% currently. Meanwhile, only 17% believe it would be beneficial for new investors to enter Ukraine (down from 32% in 2023 and 17% in the second half of 2022).

Looking ahead to the next six months, 49% of CEOs expect further deterioration in Ukraine’s investment climate, 33% expect no changes, and 18% hope for improvement. The outlook within their own sectors is similar: 44% expect a decline, 43% anticipate stability, and 13% foresee improvements.

Russian military aggression remains the top negative factor affecting the investment climate, followed by corruption, a weak judicial system, the shadow economy, and attacks on Ukraine’s energy system. Additionally, 81% of companies surveyed view currency restrictions as a negative factor impacting Ukraine’s investment appeal.

This year, business leaders cite Ukraine’s EU candidate status, tariff and quota elimination for Ukrainian exports, the “transport visa-free regime” with the EU, digitalisation of public services, and integration into the unified European electricity system as positive factors.

Slightly more than half, or 54%, of companies reported losses due to hostilities. Among these, 25% have already approached law enforcement agencies, while another 11% plan to do so. Additionally, 3% have sought recourse through national and international courts.