The rating agency ІВІ-Rating reported the affirmation of the credit rating of Odessa at the uaÐ grade with the "in development" outlook and the rating of investment attractiveness at the invÐÐ- grade.

These rating levels reflect the excellent investment attractiveness and high ability of the City to settle its obligations. The outlook “in progress†indicates a high probability of a change in the credit rating throughout the year.

Currently, this forecast applies to all rating entities. It is due to the increased uncertainty regarding the actions of the authorities and economic entities in the event of an exacerbation of the epidemiological situation in Ukraine and the world. The “-†designation indicates an intermediate rating category relative to the main category.

When updating the ratings, the following were taken into account:

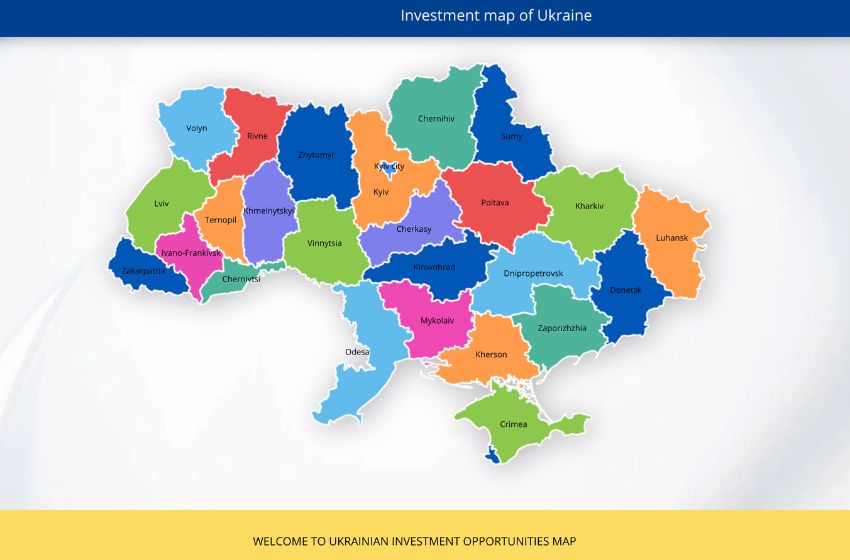

- The structure of the city's economic complex and the values ​​of indicators of socio-economic development. Odessa is the economic center of the Southern part of Ukraine and one of the largest logistics centers in Ukraine. A significant number of operating enterprises, the status of one of the largest tourist centers in the country and more than 1 million people ensure high domestic demand for goods and services, as well as create a good basis for the further development of the manufacturing sector and the transport industry. As a result, a number of indicators of the socio-economic development of Odessa per 1 inhabitant exceed the average for Ukraine. In particular, the volume of retail trade, foreign trade turnover of services, the volume of housing commissioned.

- Level of budgetary provision of the city and debt burden. The city of Odessa is characterized by a high level of budgetary provision: the volume of its own budget revenues per capita according to the results of the first half of 2020 amounted to UAH 3.7 thousand, which is higher than the indicator for Ukraine as a whole (UAH 3.3 thousand). The budget of Odessa is characterized by a sufficient level of liquidity. The budget surplus according to the results of the first half of 2020 amounted to UAH 64.36 million. Odessa City Council and utilities attract funds from domestic banks and international organizations, including for the modernization of infrastructure facilities. The direct and consolidated debt burden of the Odessa City Council is moderate. At the same time, maturities are diversified in time, which avoids peak loads.

- Sensitivity of the city budget and economy to the impact of negative factors. The city has a diversified economy and moderate budget sensitivity to the activities of individual enterprises and industries: budget revenues for 6 months. In 2020, from the TOP-20 taxpayers accounted for only 7.94% of the amount of tax revenues. The introduction of quarantine at the end of the 1st quarter of 2020, as well as the exemption of enterprises from paying certain taxes during the quarantine period led to some reduction in tax revenues, but according to the results of the 1st half of 2020, the own budget revenues of Odessa decreased by only 0.96%, compared to the same period of the previous year.

- Natural and geographical potential and the availability of a material base for business development, Favourable geographical position and natural and climatic conditions are advantages for the development of foreign economic activity and attracting investors. A good supply of health care, education and culture institutions, as well as the presence of historical monuments makes it possible to develop tourism.

The City has a strong personnel potential due to the presence of numerous institutions of higher and vocational education, as well as scientific institutes. At the same time, the cost of labour resources is lower than in the capital.

Additional advantages are the developed engineering and transport infrastructure and the efforts of the local authorities towards its modernization, as well as the policy of the city authorities aimed at improving the investment climate, including the creation of free economic zones.

For the analytical study, materials received from the city of Odessa were used, including: indicators of socio-economic development, statistical data, treasury reports, program materials, other necessary internal information, as well as information from open sources that the Rating Agency considers reliable.

ІBI-Rating was founded on 07 February 2005. Over the five years of its operation as an independent rating agency, before obtaininig the status of an authorized agency in 2010, ІBI-Rating had accumulated an extensive client portfolio in the segment of optional rating. In addition, analytical research and legislative initiatives have always been and still remain an important area of the agency’s activities.

The Agency has assigned and maintained about 200 ratings. Clients of the agency represent all sectors of the economy, i.e. corporate, financial and municipal sectors. Moreover, IBI-Rating has been actively involved in many processes taking place in the financial market of Ukraine. In particular, it has acted as an organizer of round tables, press conferences, and it also studies the legislative activity of regulators.

Source: Edinaya Odessa