Robert Kiyosaki, author of a number of books on financial planning such as Rich Dad Poor Dad and Cashflow Quadrant, recently wrote:

"What do you do if you throw a party and no one shows up? The Fed held an auction to sell U.S. bonds, and no one came. So the Fed quietly bought $50 billion of its own fake money with fake money. Hyperinflation is here. Millions of people, young and old, will be financially destroyed... Gold will rise to $25,000. Silver — to $70. Bitcoin — to $500,000, maybe even $1 million. The end I warned the world about has arrived."

Why has the Federal Reserve become the lender of last resort for the U.S. Treasury Department?

Mainly because of the collapse of the global carry trade system.

Carry trade refers to the practice where a number of countries borrow money in their domestic capital markets at low interest rates and invest it in foreign financial instruments with higher returns.

As the saying goes, they live off "those five cents" — the margin.

For this system to function, there must be significant amounts of domestic liquidity available at near-zero interest rates.

Such resources existed in Japan (where the central bank maintained a policy of negative interest rates for a long time and consumer price deflation was recorded), in Germany (which also had a cheap funding track, though shorter than Japan’s), and currently — in China (where rates are not zero or negative but are close, and where deflation is observed from time to time).

The classic carry trade is the investment of cheap capital into high-yield instruments of developing countries.

Developed countries offer stability, but low marginal returns on capital. Developing countries are high-risk, but offer significant returns.

The Global South invested in the West seeking stability, and the West invested in the Global South seeking high profitability.

This formed the "great circle of life" or the financial "food chain."

But carry trade didn't only operate along the rich-poor country axis.

It also functioned within rich country models: liquidity donors vs. liquidity recipients.

For example, Japan–USA was such a pair — a donor and recipient.

As mentioned earlier, the largest countries involved in carry trade are Japan, Germany, and China.

This can easily be verified by looking at the Net International Investment Position (NIIP) — which measures the extent to which a country’s external assets exceed its liabilities.

Germany has the world’s largest NIIP: nearly $4 trillion as of the end of 2024.

Japan is second: $3.7 trillion.

China’s NIIP is $1.8 trillion.

These are the world’s biggest creditors.

But whom do they credit?

Japan used to credit the U.S., being the largest holder of U.S. Treasuries in the world.

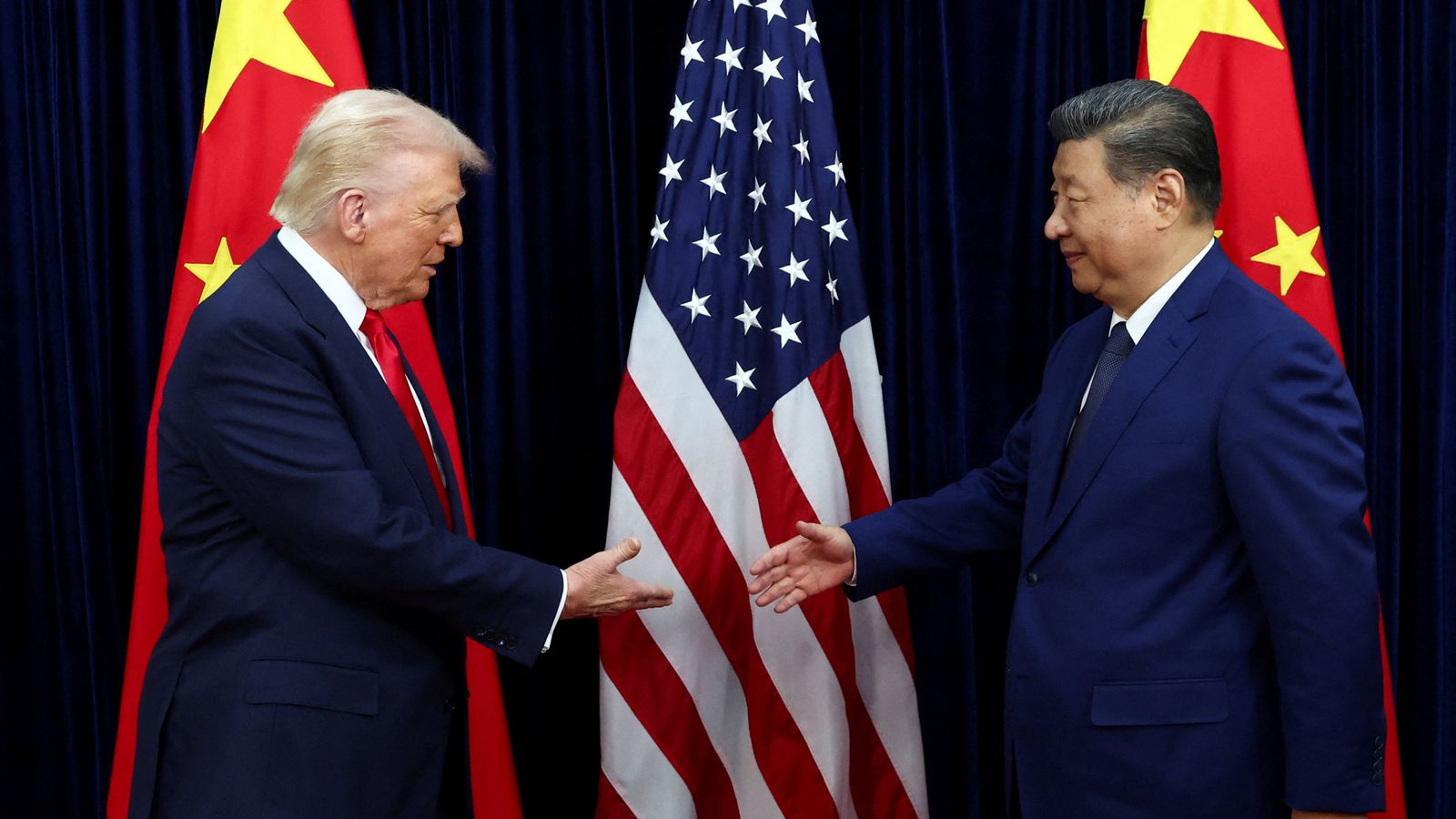

But Japan has now exited its negative interest rate track, and the carry trade model has collapsed: since 2024, Japanese investors have been actively selling Treasuries, with a peak in sales in April 2025 — a move that even forced Trump to delay the introduction of tariffs by 90 days.

Germany used to credit Central Europe. The Polish economic miracle wasn't just the Balcerowicz model.

Without German money, shock therapy would likely have led to the same results as reforms in Ukraine — deindustrialization and desocialization.

But based on the German carry trade, Poland and all of Central Europe took off.

Sometimes, good ideas without money remain just ideas. But truth be told, money is usually only given to good ideas — not the other way around.

China has been investing its capital into Belt and Road Initiative projects around the world, primarily in Asia.

Now, two carry trade models have "disconnected": the German and Japanese ones.

This means that within the framework of the U.S. Treasury market, America will now have to operate without Japanese money (just as it previously lost Chinese support), and Central Europe — without German money.

Let me know if you'd like this text summarized, adapted for publication, or formatted differently.

However, Asia, Africa, and Latin America can still count on Chinese money and the Chinese carry trade.

A large pool of countries with negative Net International Investment Position (NIIP) will face hard times.

For example, in 2024, the United States’ NIIP stood at -$26.23 trillion.

In other words, the U.S. had attracted $26.23 trillion more from abroad than it had invested overseas.

Poland’s net investment position amounted to $103.2 billion USD.

This was mainly due to a historic peak in foreign direct investment (FDI) in the Polish economy, reaching nearly €260 billion in 2023.

It’s also worth remembering Poland’s external debt, which is around €466 billion.

This is precisely why the budget deficits of Poland and the U.S. are so similar in relative terms—over 6% of GDP.

Both Poland and the U.S. have grown used to living off the carry trade.

Poland funded through Germany, and the U.S. through countries like Japan.

If the old global system is broken—bring in another one.

This is what drives the “anti-globalism” of Trump and the Republicans.

In the past, the U.S. profited from the global system at the expense of the rest of the world (a system of global unequal exchange: fiat reserve currencies for real material resources).

But now, the global system—represented by a number of countries—has started to profit from the U.S., demanding ever-higher returns on their capital.

So when I speak about the dismantling of the "global dollar standard" as the universal benchmark, I’m not referring to the regionalization of America as a geopolitical force, but rather to the transformation of the old global fiat dollar model into a new system.

And the U.S. does not want to lose its leadership in this new system.

Many today are writing about the collapse of the Bretton Woods monetary system, established after World War II and based on the dominance of the "gold-backed dollar standard."

But this is a highly inaccurate statement.

Bretton Woods "died" in 1971 when Nixon ended the gold standard.

Today’s world operates under the Jamaican monetary system, established in 1976 in Kingston, Jamaica, during an IMF conference.

It is precisely the Jamaican system—based on unsecured fiat reserve currencies whose exchange rates are determined by the “market”—that is now dying.

And replacing it is digital fintech, which currently has only two major directions: central bank digital currencies (CBDCs) and cryptocurrencies like Bitcoin.

In the U.S., it is well understood that a national digital currency model leads to regionalization.

That’s why the U.S. seeks to seize leadership in the world of cryptocurrencies, as Vice President J.D. Vance recently stated at a conference.

But how can cryptocurrencies be combined with the Treasury market’s need for new liquidity flows?

Howard Lutnick, the current U.S. Secretary of Commerce and an active participant in the "cryptofication" process, names USDT as such an instrument—a link between fiat and crypto that combines the convenience of cryptocurrency with the stability of the fiat dollar.

The mechanism is quite simple: a cryptocurrency is issued against the collateral of reliable dollar-denominated instruments.

And the main form of collateral is U.S. Treasuries.

Thus, the scheme’s organizers are guaranteed to profit: they earn commissions from circulating USDT and also receive income from the collateral instrument—i.e., the coupon yield on the Treasury portfolio.

In this way, the future financial system is a digital model which, according to Washington's plan, just like the “golden” Bretton Woods system or the “fiat” Jamaican system, should serve the U.S. debt market—that is, funnel global liquidity toward Treasuries.

How successful the U.S. will be in capturing this digital initiative will determine how well it can redirect global liquidity flows back into Treasuries in the future.