The international financial service NovaPay has registered a new bond issue, Series “K,” for UAH 100 million, with a maturity date of August 6, 2028. This is already the third issue aimed exclusively at institutional investors, according to the company’s press release dated September 11. The issuer is a subsidiary—NovaPay Credit LLC. The coupon yield will be 18% per annum, with interest payments made quarterly.

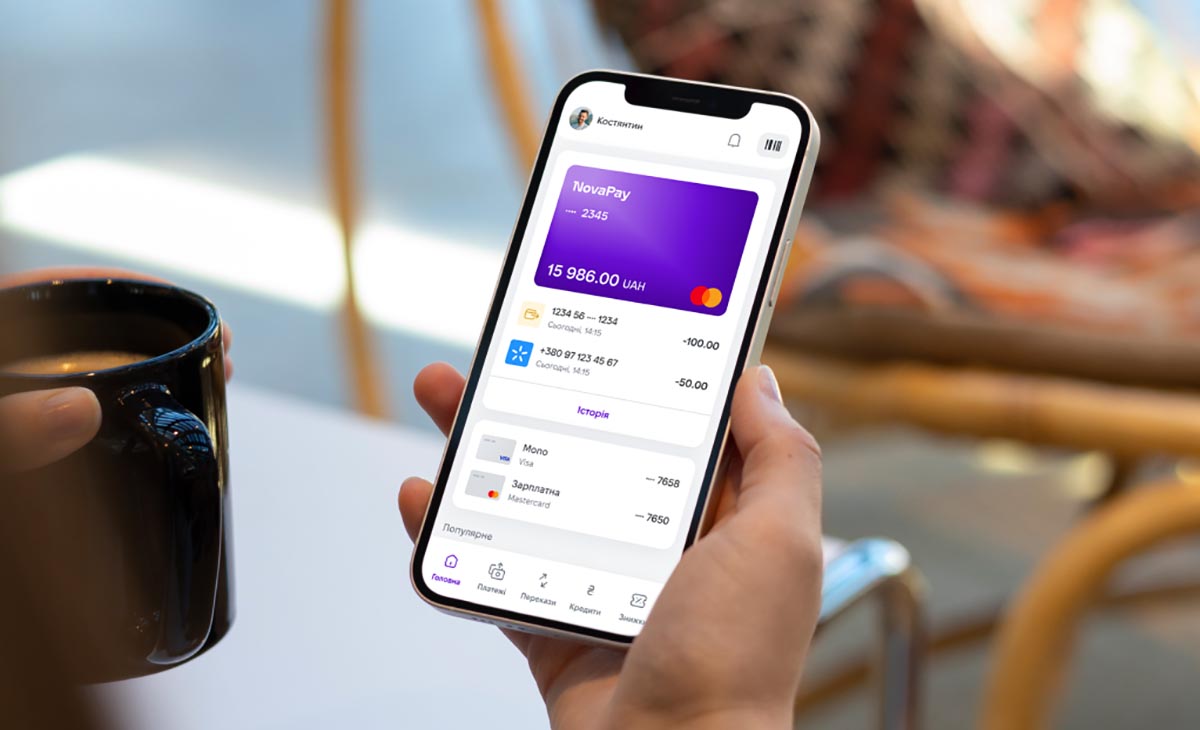

Previously, NovaPay fully placed Series “C” and “I” bonds among institutional investors for a total of UAH 190 million. Overall, the company conducted nine bond issues in 2023–2024, added a tenth in 2025, and announced a twelfth—Series “L,” also for UAH 100 million. Most series (except for three) participate in the REPO program as an alternative to bank deposits and are available for purchase via the NovaPay mobile app.

Founded in 2001, the company is part of the Nova Group and provides financial services both online and through post office branches. According to its website, NovaPay employs approximately 13,000 people across more than 3,600 branches throughout Ukraine. According to the National Bank of Ukraine (NBU), the service controls about 35% of the domestic money transfer market.

In 2023, NovaPay became the first non-bank organization in Ukraine to receive an expanded license from the NBU, allowing it to open accounts and issue cards. At the end of 2024, the company also became the first among non-bank players to launch its own financial app with a full range of services.

According to the bond prospectus, NovaPay Credit expects interest income to grow to UAH 802.1 million in 2025 and to UAH 1.515 billion in 2026. Expected net profit is projected at UAH 518.9 million and UAH 1.03 billion, respectively.

In 2024, the company’s net profit doubled to UAH 89.2 million (up from UAH 40.3 million in 2023), while revenue increased to UAH 285.6 million (up from UAH 95.6 million).